Double the loans – the power of Kiva repayments

By AdministratorDuring Q4 2013, Foundation Beyond Belief funded a pilot program to create and administer an FBB Kiva account. Our initial goals were to dip our toes in the world of microfinance. Kiva’s microfinance platform is the largest, giving access to a range of loans from thousands of different providers around the world. FBB members supplied initial funds totaling $2,500 when we launched this program a year ago. By the end of February, we loaned out our entire initial investment and had helped fund 102 loans. As loan repayments accrue in our Kiva account, we continue to fund new loans.

We established guidelines for how to select loans as we learned to navigate the Kiva world. First, we would only loan to secular MFIs (microfinance institutions – the entities that actually supply the loan to the individual or group). Luckily, one of the “teams” on Kiva is the Atheists, Agnostics, Skeptics, Freethinkers, Secular Humanists and the Non-Religious team (or A+ team). They maintain an extensive list showing the religious orientation of different MFI providers. We used this list to direct our giving. We wanted to give to as many borrowers as possible, as quickly as possible. In this endeavor, we loaned the minimum amount of $25 to each borrower (a practice I discovered is commonplace among givers). We also looked for loans where the repayment schedule was quick and monthly. This meant a very significant number of our initial loans were made with repayment terms of 6-14 months on a monthly basis, allowing us to recycle our initial deposits quickly.

The options for loans can be endless; as we make new loans with our repayments, we make adjustments to our criteria. Originally, we wanted to make three loans per country in countries that had secular MFIs and we wanted to also focus on countries visited by Pathfinders Project. We quickly learned that adhering to even a small number of guidelines was difficult, and personal biases would always play into the selection process.

Individual Stories

Kiva is a middleman. Loaners (that is us!) supply interest-free loans to microfinance institutions that are affiliated with Kiva, and the MFIs manage the loans in country (given to the borrower). There are some very interesting stories of individuals who received loans funded in part by FBB.

Photo credit: Quinn Norton

Who knows what a baobob tree is? Until last week, I had no idea. Foundation Beyond Belief helped fund a group that is utilizing the seeds of the baobob tree. The fruit is utilized as a food source and traditionally the seeds were discarded. This team creates three products from different types of Baobab seeds.

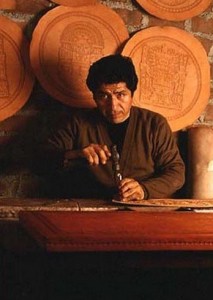

In a loan environment dominated by retail, food, and agriculture, occasionally a loan stands out. In the arts category, Abel’s craftsmanship with wood and leather, creating beautiful pieces, drew me to find out more. Abel’s microfinance organization is Novica. Novica works with National Geographic to create an online marketplace for goods from the people they fund. The loan repayments are partially tied to the profits made through these sales. Abel has a 14-year relationship with Novica.

In a loan environment dominated by retail, food, and agriculture, occasionally a loan stands out. In the arts category, Abel’s craftsmanship with wood and leather, creating beautiful pieces, drew me to find out more. Abel’s microfinance organization is Novica. Novica works with National Geographic to create an online marketplace for goods from the people they fund. The loan repayments are partially tied to the profits made through these sales. Abel has a 14-year relationship with Novica.

Photo credit and more information on this product available here.

Another innovative lender in Kiva’s system is Barefoot Power. They work with entrepreneurs to develop businesses using renewable, specifically solar, power. Suraj has a business and associates that sell Barefoot Power Products in areas that don’t have easy access to the electrical grid.

For every one of these loans, we have 10 retail and agriculture loans helping people maintain their established businesses by purchasing stock or agricultural materials. These loans are no less important and equally interesting, but much more common. One observation I have made is that many of the loan recipients use these loans as a source of funds regularly to manage their seasonal costs versus their profit times of the year.

Team dynamics

Kiva allows lenders to join a team or multiple teams to participate in group loaning, conversations, and questions. We immediately joined the A+ Kiva team.

Being part of the team has been interesting. Each month we post what loans we have made from our repayments. But the team has many interesting fun loan games. Every week, the Kiva A+ Facebook group sponsors one loan for members to flash-mob loan at the same time, in order to increase the loan on the popularity screen on Kiva and get it fully funded. The team also sponsors three Loan-a-Thon events a year. Often, there will be an announcement when a rare or new country becomes available (some Kiva loaners are country collectors).

Statistics

This post was intended to celebrate our 204th loan, doubling our loans through repayments in just eight months, but we fell a little shy. We have actually loaned a total of 196 loans. This will easily be fixed in two weeks, as our December repayments begin to arrive into our account and we will be able to make approximately 15 more loans.

As of now we do know that we have loaned to borrowers in 48 countries. 56% of our borrowers are women, 44% men. We have loaned in 15 different sectors, with retail, agriculture, and food being our top three sectors.

We have had two loans default, and an additional 159 are paying back. Thirty-four borrowers have already paid back their entire loan. The default rate is slightly higher than average; however, we have not used the financial criteria of a lender or their default rates as a criteria for choosing loans.

Kiva loaning, and microfinance in general, is an interesting way to be involved in development in as close to a one-on-one manner as most of us can experience. There are many studies that show the positive and negative effects of microfinance institutions on different communities. As we continue to loan the repayments we receive, and learn more about the process, we will share that information with you.